Executive Summary

The Mixed Martial Arts (MMA) market is characterized by the dominance of the UFC and the rapid emergence of several major global and regional promotions, including ONE Championship, PFL, BKFC, and Oktagon MMA. The period from 2020 to 2025 shows a market that is not only growing at the top but also diversifying, with secondary promotions successfully carving out significant market share through distinct formats and regional focus.

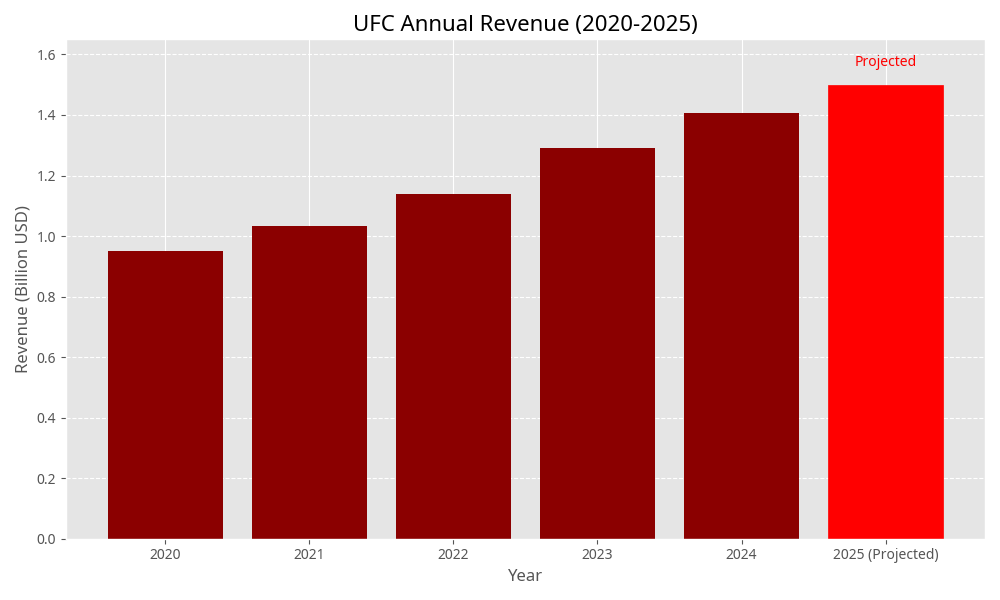

The UFC maintains its financial lead with a 10.30% Revenue CAGR (2020-2024), while promotions like ONE Championship and PFL are demonstrating aggressive growth strategies, particularly in event volume and international expansion.

1. Market Dominance: Ultimate Fighting Championship (UFC)

The UFC remains the undisputed market leader, consistently increasing its annual revenue and maintaining a stable event schedule.

UFC Annual Revenue (2020-2025)

1.1 UFC Revenue Structure and Key Income Streams (2024)

In 2024, the Ultimate Fighting Championship (UFC) achieved record annual revenue of approximately $1,406 million (≈$1.4 billion), a 9% increase compared to the previous year.

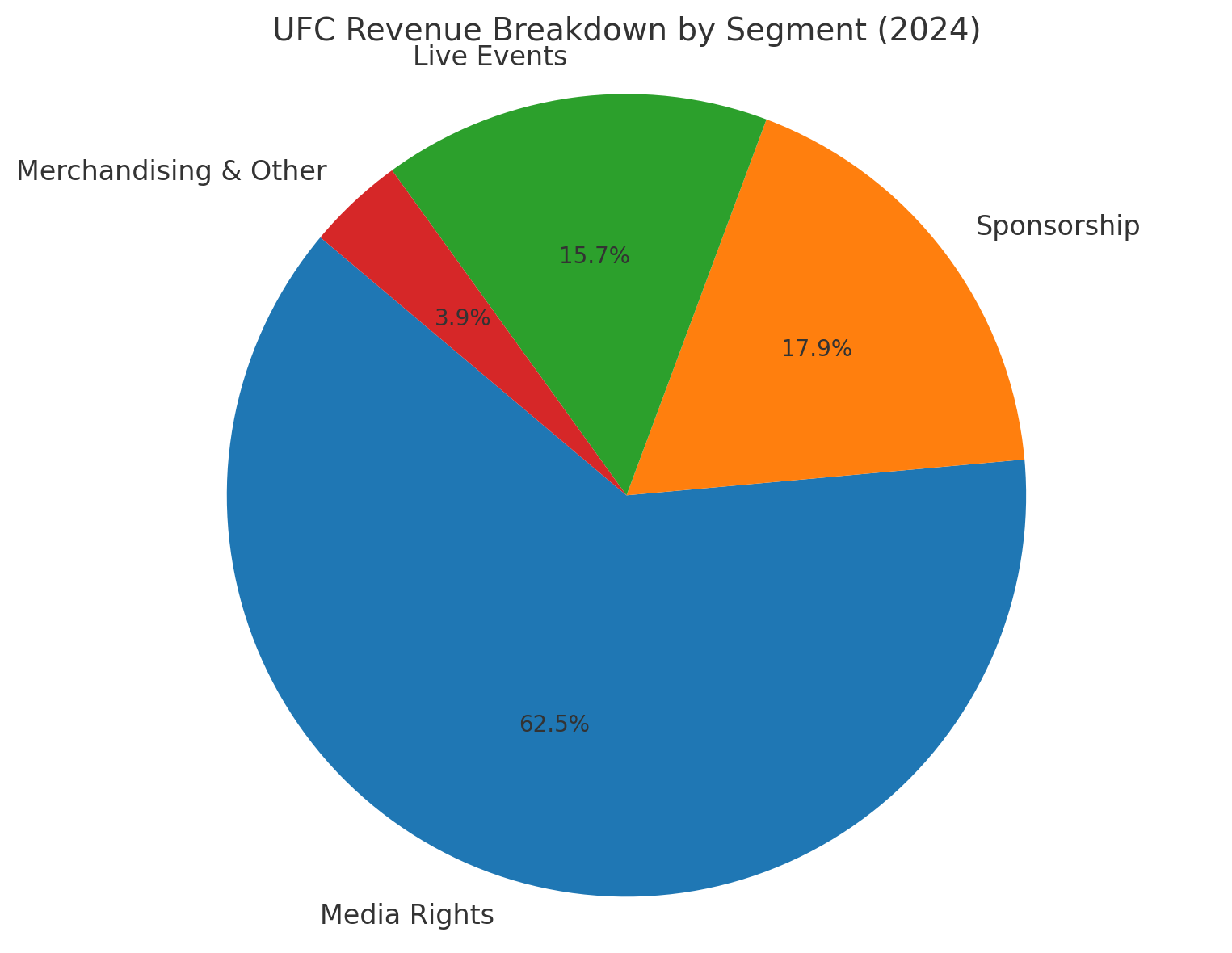

According to the TKO Group Holdings annual report, UFC’s revenue comes from four primary streams: media rights (content distribution), ticket sales and live event site fees, sponsorships, and consumer product licensing (merchandising). Below is a detailed breakdown of UFC’s revenue by segment for 2024:

- Media Rights & Content Distribution – $879.4 million (≈62.5% of total revenue)

- Sponsorship – $251.4 million (≈17.9%)

- Live Events & Ticket Sales – $220.4 million (≈15.7%)

- Merchandising & Other – $55.0 million (≈3.9%)

Media Rights & Content Distribution (≈62% of Revenue)

Media rights are UFC’s largest revenue stream, generating $879.4 million in 2024. This includes payments from broadcasters and streaming platforms for the right to air UFC content domestically and internationally. In 2024, media revenue rose by just 1% year-over-year (+$8.8 million), reflecting the stability of long-term contracts.

A cornerstone of this segment is UFC’s exclusive deal with ESPN in the U.S., originally signed in 2019. The multi-year partnership, estimated at $1.5 billion over its term, includes both linear broadcasting and pay-per-view (PPV) distribution via ESPN+. Industry analysts estimate that these two ESPN agreements alone contribute approximately $550 million annually to UFC’s media revenue.

This partnership has ensured a consistent revenue stream and wide audience reach. TKO leadership is already preparing for the next media rights cycle post-2025, aiming to surpass $1 billion annually in new deals. As such, media remains UFC’s financial cornerstone, and upcoming negotiations may significantly reshape the scale of this segment.

Sponsorship (≈18% of Revenue)

Sponsorship is UFC’s second-largest revenue stream, generating $251.4 million in 2024, about 18% of total revenue. This represents a remarkable 28% increase over the previous year ($196.3 million in 2023).

The report attributes the $55.1 million increase to an influx of new sponsors and higher rates from contract renewals. UFC monetizes its global appeal through long-term deals with brands across multiple sectors, from sports drinks and betting to crypto and tech.

A prime example is the historic 10-year, $175 million partnership with Crypto.com, making it UFC’s largest sponsorship deal ever. Other notable sponsors include Monster Energy, DraftKings, PRIME Hydration, and more.

This makes sponsorship the fastest-growing segment in 2024, contributing over one-third of UFC’s total annual revenue growth. It reflects UFC’s value as a premium advertising platform and the strong commercial appeal of its audience.

Live Events & Ticketing (≈16% of Revenue)

UFC’s live event revenue, which includes gate ticket sales and host location (site fee) payments, reached $220.4 million in 2024, around 16% of total revenue. This marks an impressive 31% growth (+$52.5 million YoY).

Growth was driven by higher ticket pricing, increased event attendance, and expanded use of site fee strategies. UFC staged slightly larger-scale events than in 2023, including one additional numbered event.

Moreover, cities and countries now actively bid to host UFC events, offering financial incentives. Notably, Saudi Arabia reportedly paid $20 million to host its first numbered UFC event in Riyadh in 2024.

TKO executives emphasized that UFC now expects substantial incentive packages from host regions due to rising demand. For example, Abu Dhabi continues to secure exclusive fight nights by offering "significant guaranteed payments" for each event.

This site's fee-driven model significantly boosted gate revenues and made live events the second-largest contributor to UFC’s YoY revenue growth. It shows that UFC’s global event strategy is increasingly lucrative.

Merchandising & Other (≈4% of Revenue)

The consumer products and licensing segment, which includes merchandising, video games, and collectibles, brought in $55.0 million in 2024, about 4% of UFC’s revenue.

This marks a slight decline from $57.4 million in 2023, attributed to a drop in royalties from branded merchandise sales. The release of EA Sports UFC 5 in late 2023 likely concentrated game-related income in the previous year.

While this segment plays a minor role in the overall revenue structure, it remains important for fan engagement and brand ecosystem development. However, its growth lags behind more dynamic streams, like media and sponsorship.

2. Comparative Analysis of Major Promotions

The secondary promotions are employing varied strategies to compete and grow, with a clear focus on event volume and geographical expansion.

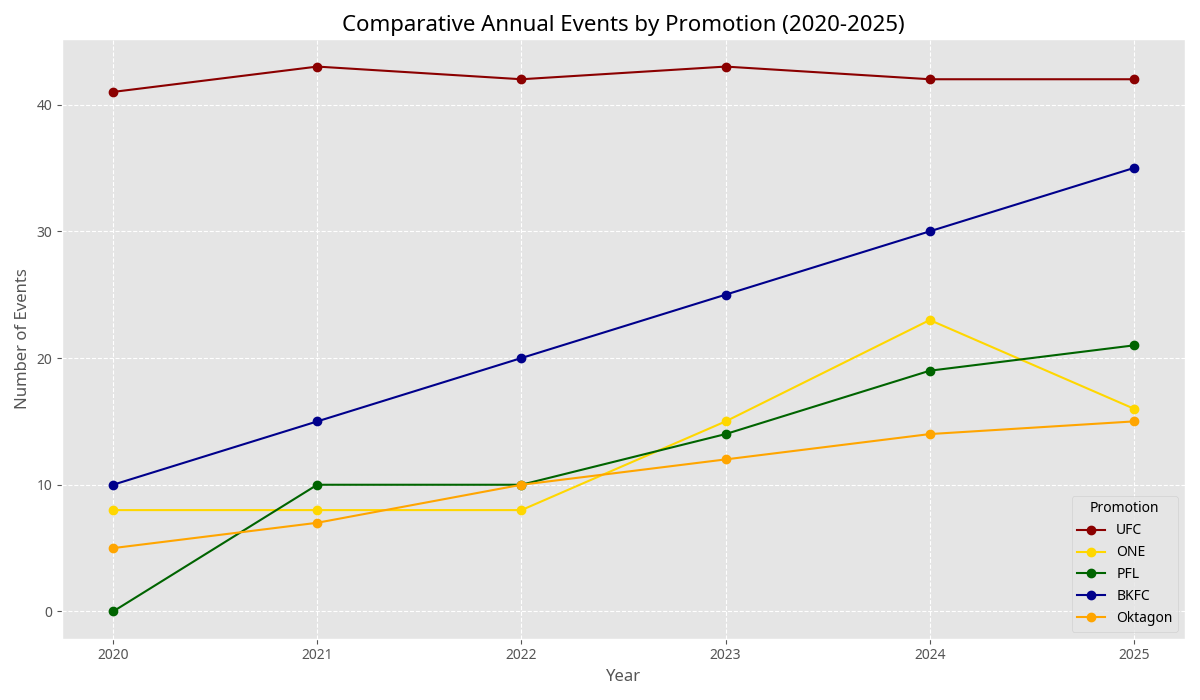

Comparative Annual Events by Promotion (2020-2025)

The chart below illustrates the significant increase in event volume from the secondary promotions, particularly ONE Championship, PFL, and BKFC, which have all ramped up their event schedules since 2023.

2.1. ONE Championship (ONE)

ONE Championship, based in Singapore, is the largest martial arts organization in Asia, featuring MMA, Muay Thai, and Kickboxing. The promotion has shown significant revenue growth, though it operates on a different scale than the UFC.

ONE's revenue has grown from $57 million in 2020 to a projected $200 million in 2025. The sharp increase in event volume in 2024, driven by the weekly "ONE Friday Fights" series in Bangkok, is a key indicator of their aggressive expansion strategy.

2.2. Professional Fighters League (PFL)

The PFL distinguishes itself with a unique league format and has achieved a $1 billion valuation. Its revenue growth is concentrated in the later years of the period, coinciding with major expansion efforts.

PFL reported its first year of over $100 million in revenue in 2024, a significant milestone. The event count has steadily increased, reflecting the growth of its main season and the launch of regional leagues like PFL Europe and PFL MENA.

2.3. Bare Knuckle Fighting Championship (BKFC)

BKFC has established a niche market with its bare-knuckle boxing format, offering a raw and fast-paced alternative to traditional MMA and boxing. Founded in 2018, the promotion gained rapid traction due to its no-gloves rule set, simplified fight structure, and viral knockouts, attracting a loyal hardcore fan base. BKFC has signed several high-profile former UFC fighters, including Mike Perry, Paige VanZant, and Eddie Alvarez, helping it gain mainstream attention. The organization broadcasts through its own BKFC App and FITE TV, with international distribution expanding in Latin America and Europe. As of 2024, it is valued at approximately $400 million and is on pace to host over 30 events annually, reflecting aggressive growth in both domestic and global markets.BKFC has established a niche market with its bare-knuckle boxing format. The promotion has seen a rapid increase in event frequency and is valued at approximately $400 million.

The promotion's growth is driven by a loyal, hardcore fan base and a high-volume event schedule, with an estimated 35 events projected for 2025.

2.4. Oktagon MMA

Oktagon MMA is a leading European promotion, primarily focused on the Czech and Slovak markets, with recent expansion into Germany and the UK. Founded in 2016, the organization has established a strong regional identity by combining high-level production with compelling storytelling centered on its fighters. Often spotlighting their personal journeys through docu-series and live events. Oktagon has pioneered fan-driven formats like the "Tipsport Gamechanger" tournament, featuring top European talent competing for a million-euro prize pool. Its events regularly sell out arenas across Central Europe and have broken viewership records, with one 2023 event reaching over 1.3 million viewers on RTL+ in Germany. Known for its professional production values and deep engagement with local audiences, Oktagon is now positioning itself as a pan-European force in MMA.

Oktagon’s rapid rise is further evidenced by its growing broadcast footprint, with major events attracting seven-figure audiences and forging strategic media deals across Central Europe, highlighting its strong resonance with regional fans and increasing pan-European visibility.

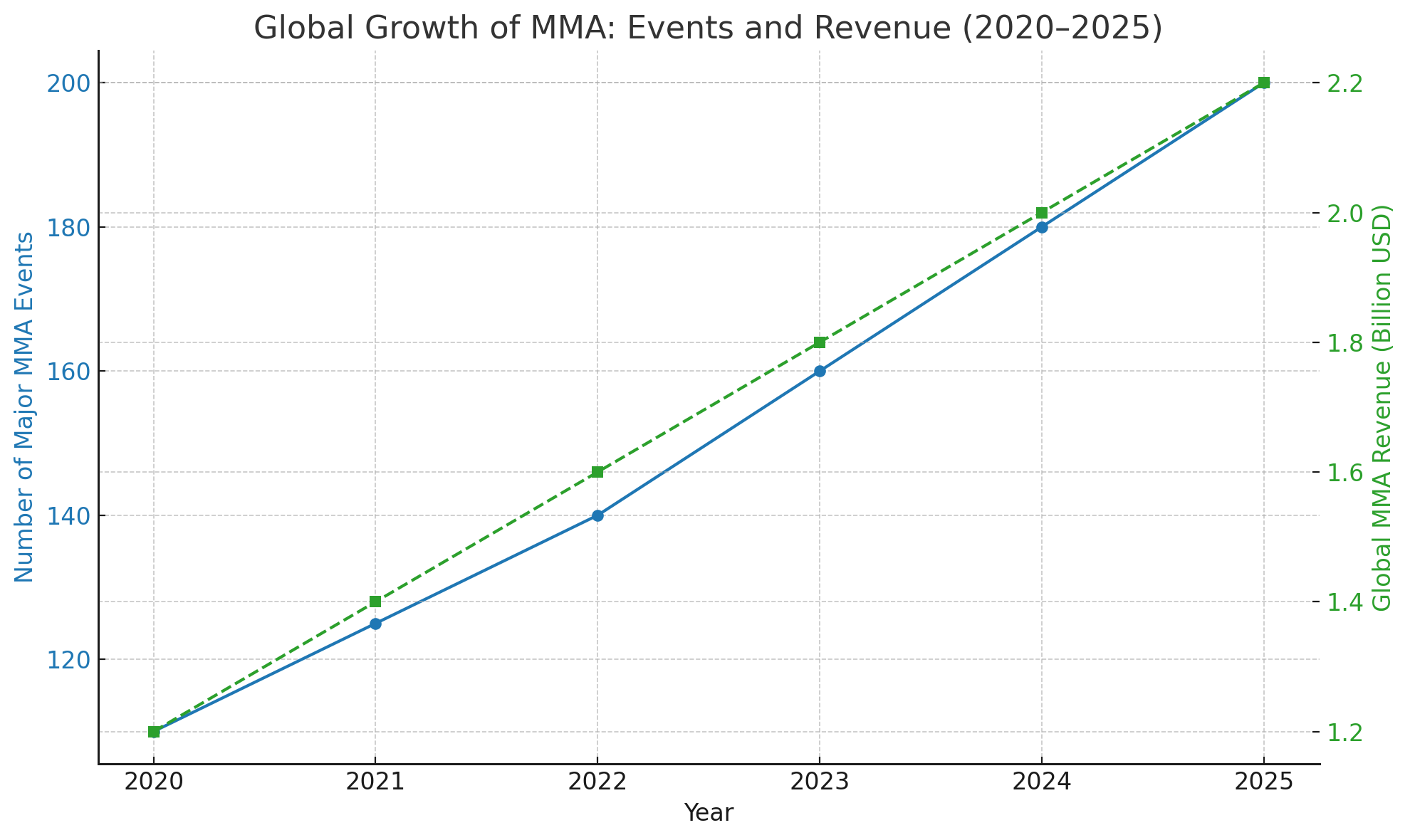

3.0 Global MMA Market

Between 2020 and 2025, the global MMA industry has experienced unprecedented expansion across both established and emerging markets. While the UFC maintained a steady cadence of 42–43 events annually, international promotions significantly increased their output: ONE Championship grew from 8 events in 2020 to 23 in 2024, and the PFL expanded from a halted 2020 season to a projected 21 events in 2025. BKFC, leveraging a high-volume model, grew from roughly 10 to 35 annual events over the same period. In Europe, Oktagon MMA nearly tripled its annual schedule. Collectively, the global MMA market went from an estimated 100–110 major events in 2020 to over 180–200 projected events by 2025, excluding regional leagues and amateur circuits. Total industry revenue, driven by media rights, sponsorships, and gate receipts, is estimated to grow from approximately $1.2 billion in 2020 to over $2.2 billion by 2025, with UFC still accounting for the majority share but with secondary promotions increasingly capturing regional market segments. This global growth highlights MMA’s evolution from a niche combat sport to a commercially mature, multi-billion-dollar entertainment industry.

Conclusion

The MMA market is experiencing a golden age of growth and diversification. While the UFC continues to set the financial benchmark, the secondary promotions are demonstrating significant momentum. ONE Championship is a major global player with a focus on the Asian market and high event volume. PFL is rapidly scaling its business model with a unique format and substantial investment. BKFC has successfully created a high-frequency niche product, and Oktagon MMA is consolidating the European market. The overall trend indicates a healthy and competitive ecosystem, pointing to continued global expansion for the sport of Mixed Martial Arts.